Almost every aspect of daily life has been impacted by the recent cost-of-living crisis, from gas prices to our weekly food shops. However, as the cost-of-living issue takes root, millions more people have been targeted by scammers, according to new data from Citizens Advice. That’s an increase of 14% from last year, and more than 75% of UK people indicated they have been the target of a scammer this year.

We have seen a staggering 170% growth in loan scams, a 131% growth in job fraud, a 128% growth in investment scams and a considerable increase in scam messages relating to energy bills over the last three months.

“We know that scammers prey on our worries and fears, and the cost of living crisis is no exception”, warns Dame Claire Moriarty, CEO of Citizens Advice.

At Bob’s Business, we aim to build a world where everyone feels safe online. As part of that mission, we have pulled together a list of some of the most prominent scams targeting individuals today, alongside advice on what to do if you fall victim. Let’s get started.

Scam type 1: Cost-of-living help

Here are the facts: the Government has announced its intention to provide a £400 non-repayable discount to households with a domestic electricity meter, to help with energy bills throughout the winter months.

The discount will be administered by energy suppliers and paid to consumers in instalments over six months, with payments starting from October 2022.

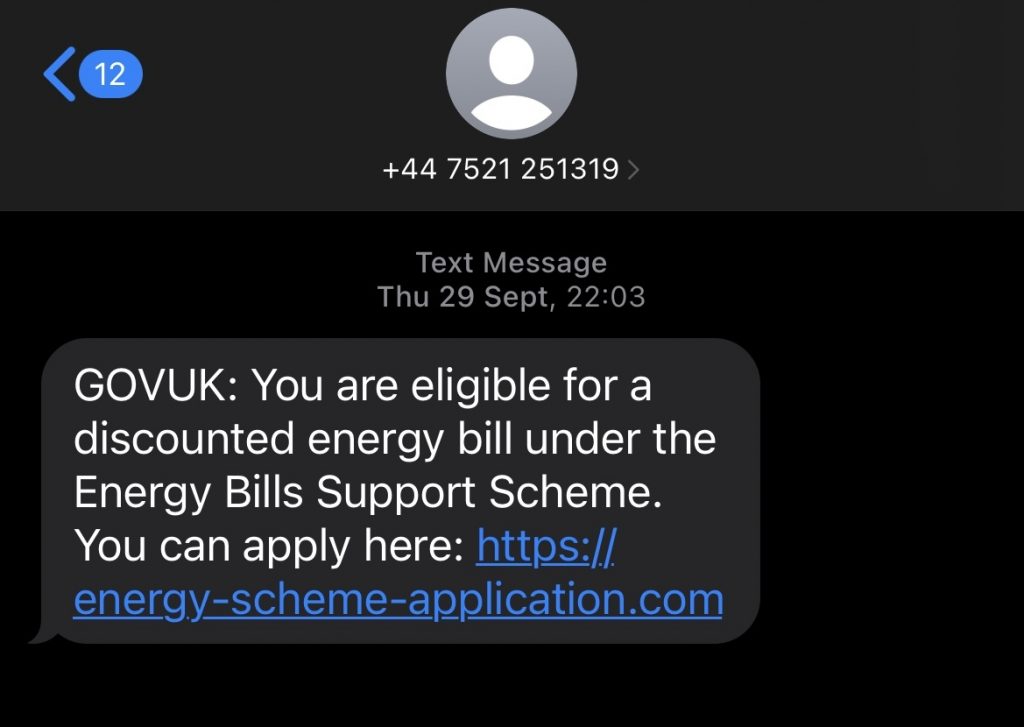

However, as householders wait for the cost of living payments to be applied to energy bill accounts, scammers are targeting individuals with texts claiming to be from Ofgem, asking people to apply for their £400 rebate. If the victim clicks on a link to enter their bank details, they could risk losing all of their bank balance.

Needless to say, these texts are fake. There are a few ways to spot this, such as the standard mobile phone number and the URL, which isn’t from a gov.uk address.

To ease confusion, here’s what you need to know about the scheme, according to the DWP:

- You do not need to apply for the payment.

- You do not need to call them.

- Payment is automatic.

- They will never ask for personal details by SMS or email.

Scam 2: Pension attacks

According to a recent study, a quarter of Brits would contemplate taking cash out of their pension account sooner than expected due to the cost-of-living crisis.

In comparison to the previous year, the number of pension pots accessed for the first time increased by 18% to 705,666 in 2021/22, according to the UK’s finance watchdog. Sadly, scammers are utilising this climate to drain people of their hard-earned money.

Be cautious if you get an unexpected text, call, email, or letter in the mail offering you something free, such as a pension review; it could be a scam. Scammers will exploit their victims’ knowledge of how pension savings work after successfully distracting their victims, in order to get their hard-earned money.

Watch out for these commonly used tactics of pension scammers and make sure you keep your pension pots safe:

- The offer of a free pension review – This can be tempting, but it could prove to be a scam and result in you losing your pension.

- Higher returns – Where scammers will guarantee they can get you better returns on your pension savings.

- Under 55 cash release – An offer to release funds before age 55 is highly likely to be a scam and has significant tax implications.

- High-pressure sales tactics – Scammers may try to pressure you with “time-limited offers” or even send a courier to your door to wait while you sign documents.

- Unusual investments – These tend to be unregulated and high-risk, they may be difficult to sell if you need access to your money.

Scam 3: Fake bank refunds

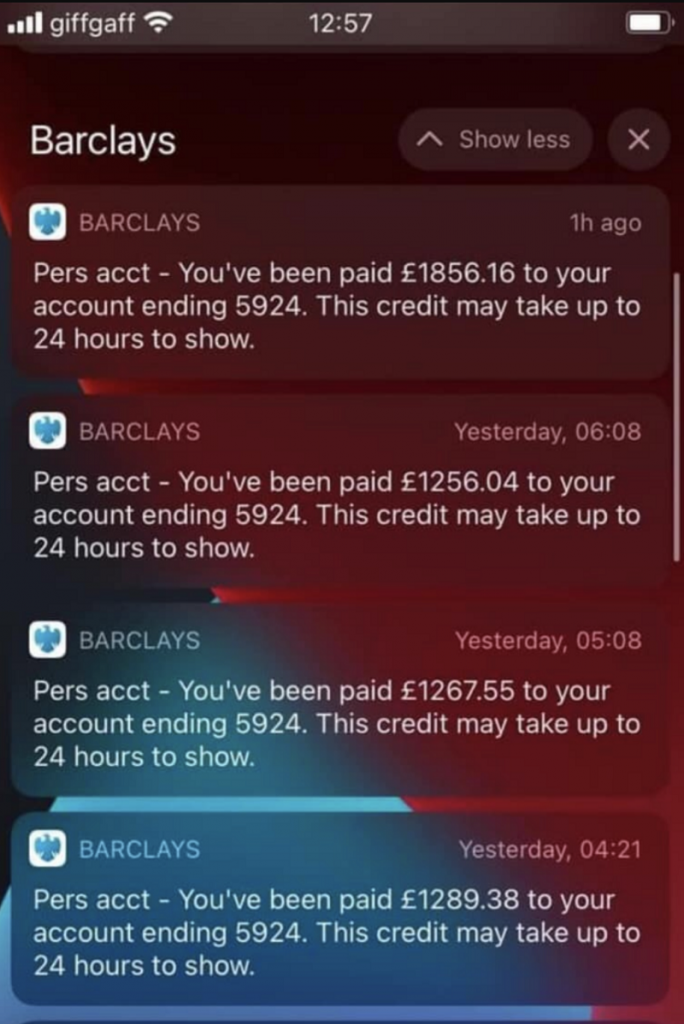

Scammers are also taking to social media to offer fake bank refunds. This scam shares a fraudulent screenshot showing amounts from £1,289 to £1,855 being deposited into someone’s account.

This scam tempts you into parting with your bank details. The scammer will use your details to set up your account on their device, giving them access to your bank account. They then use the banking app to dispute a transaction and get a refund.

What to do if you think you’ve been scammed

- Talk to your bank or card company immediately if you’ve handed over any financial or sensitive information or made a payment.

- Report the scam to Citizens Advice. Offline scams, like telephone, post and doorstep. Report on the Citizens Advice website or by calling 0808 223 1133. Report online scams to the dedicated Scams Action service either online or on 0808 250 5050.

- Text scams can be reported to your mobile phone provider by forwarding them to 7726.

- Report the scam to Action Fraud on 0300 123 2040.

How to avoid getting caught by scammers.

- Don’t send money to anyone you don’t know, and don’t buy anything you aren’t completely sure of.

- Offers that seem too good to be true often are. The Financial Conduct Authority website has a list of genuine companies whose details you can check.

- Watch out for spelling and grammatical mistakes, inappropriate or informal greetings, and sloppy layouts in texts and emails.

- Don’t download files or attachments from suspicious sources, make sure your antivirus software is up to date and run a scan before opening anything you’re suspicious of.

- Do not call unknown phone numbers from such emails, especially if they appear to be premium rate numbers. Remember, you can contact your service provider to check the cost of dialling particular numbers.

- Fraud can also happen in person, so don’t allow doorsteps or anyone you feel uncomfortable with into your home.

Finally – do not be ashamed. Anyone can be a victim of fraud. Be honest with yourself and ask for help, it’s the fastest way to get to a solution.

Keeping your organisation secure

Whilst these cost-of-living scams target individuals, businesses are just as liable to be attacked – especially with inflationary pressures coming to bear on companies.

That’s why it’s more important than ever to ensure you’re giving your team amazing cybersecurity awareness training to help reduce their risk of falling victim to an attack – both at home and in the office. Start training your employees today.